David Beak Facilitates $5.5M Sale of Norcross Office/Warehouse Properties

April 24, 2019

Atlanta Office & Industrial Market Reviews: Q1 2019

May 17, 2019David Beak, Nathan Anderson Facilitate Sale of Breckinridge Portfolio; Mike Berens, Logan Haner Tapped As Leasing Brokers

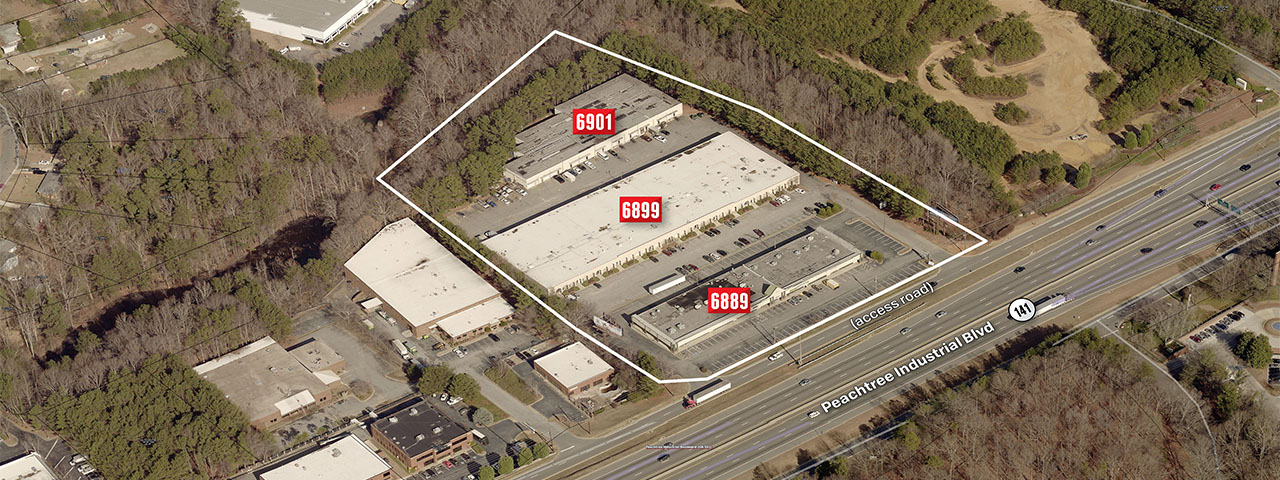

RealOp Investments has expanded its Southeastern footprint with the acquisition of three single-story office parks in the northeast submarket and I-85 corridor of Atlanta.

The portfolio totals 560,000 square feet across twelve buildings, which were approximately 72 percent leased at the time of sale. The acquisition presents a value-add opportunity with steady in-place income, said Julian Nexsen, RealOp’s vice president of acquisitions and business development.

Nathan Anderson and David Beak of NAI Brannen Goddard represented the seller in the transaction, which closed on May 2. Major tenants include Primerica, Polytron, UPS, and Q-Matic. The office parks provide excellent accessibility to I-85, popular amenities and neighborhoods, and are located within Gwinnett County’s Opportunity Zone, which offers tax credits to tenants based on job creation.

RealOp’s renovation and repositioning plans include upgrades to the building amenities and outdoor space, the addition of on-site food truck offerings, as well as cosmetic enhancements to signage, landscaping, and paved surfaces within the parks. Additionally, RealOp is launching an aggressive leasing and rebranding campaign in order to provide a “best in class” office experience for existing and future tenants, said Chip Hunt, RealOp’s vice president of leasing.

“We have selected a very strong leasing team, led by Mike Berens and Logan Haner with NAI Brannen Goddard, and are excited to get started. Initial marketing and outreach efforts will highlight our ability to provide tenants with high-end, updated spaces in well-located properties, front-door parking and the ability to sign leases that do not include costly common area factors,” Hunt said. “We also are investing heavily in efforts to build a stronger brand and sense of place for each of the parks as well as the overall portfolio.”The parks are currently branded as Breckinridge Exchange, Breckinridge Center, and Park Creek, though renaming is currently under consideration. The acquisition expands RealOp’s portfolio to five Southeastern states and ten markets.

News via Greenville Business Magazine and RealOp Investments.